Last year has not been a great year politically and it made me and the people around me feel quite powerless. However, there are other ways to make an impact and one of my favourite ways will also make you money (yay!). I am talking impact investing. Over the years I have gained knowledge and experience in various ways to invest that leaves a positive impact on this world. Here, I will discuss what I have found. My knowledge comes from experience, mutliple sources that I have used over the years, and, lately, from the book ‘Girls just wanna have impact funds’ from Female Invest. I am definetely no expert but I hope this information is useful to you.

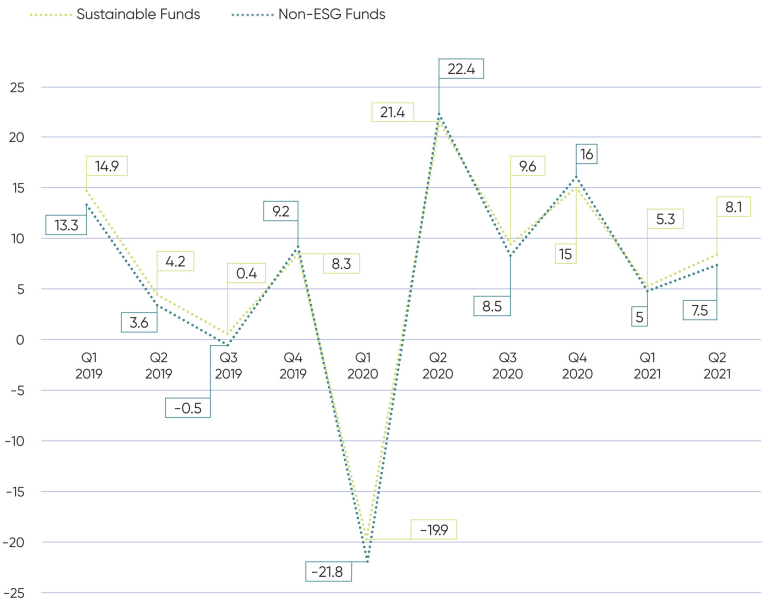

Impact investing can make the same amount of profit as non-sustainable investing. So why not choose for the investments that make you feel good about the future?

Returns of sustainable funds vs. other funds in the U.S 2019-2021

Source: Girls just wanna have impact funds from Female Invest. Data from: dbSustainability - Are we at an inflection point for a major advance in ESG fund launches? September 2021. Fig. 9 (Source: Morningstar Direct, Deatsche Bank)

Before we start

Although investing is a great way to use your money to make more money, it does come with a risk. Often risk and potential returns go hand in hand (high risk, high reward). Having a diverse portfolio of investments can spread out the risk (don’t just bet on one horse). Additionally, I don’t think investing is for short term gains. Long-term investing shows to be a better strategy than investing short-term, as markets are less volatile in the long-run. I would suggest to invest for at least five years but prefarably much longer (have patience to build that fortune). The cool thing about investing is compound interest which is the concept of making profit over profit if you invest long enough. I would also suggest to invest periodically (not one large sum at one time) as markets can shift and in this way you spread your risks.

Savings account at sustainable bank

Low risk, low interest, easy, moderate impact

The easiest option in my opinion is opening a savings account at a sustainable bank. Non-sustainable banks might invest your money into fossil fuels, weapons and/or industrial agriculture whilst sustainable banks use your money to invest in, for example, renewable energy and regenerative agriculture. Interest rates on savings accounts are relatively low but also low risk. You can start with any amount of money and you can take money out of your savings account in moments of unemployment or whenever an emergency occurs. Make sure you have 4 to 6 months of savings at all time for emergencies. You will hardly ever loose money with this option.

Sustainable Dutch banks: Triodos Bank and ASN Bank

Investing through funds at a bank

Risk and interest depend on fund, easy, moderate to high impact

This is also a really easy option if you choose to invest at a sustainable bank. Most banks have different funds available in which you can invest, differing in risk, reward and impact. You often pay a (slightly) higher fee than with other forms of investing as the bank does the sustainability research for you and it makes things a lot easier. For me the extra fee is okay as it saves me a lot of extra time and it is easy to do through my bank. You can start with any amount of money but I do recommend investing periodically. You can take money out at any time but you can lose money if the fund is not doing well at that specific time. The last two points also count for stocks, bonds and ETFs.

Stocks

Risk high, high potential returns, difficult, high impact

With buying stocks you are basically buying a part of a company. The impact can be related to simply funding companies that make a positive impact on the world but are also high in impact as investors make demands on companies. I would say this is one of the harder options as individual stocks are hard to pick and sustainability or social impact of companies are often hard to gauge (even with metrics such as ESGs). I hardly deal in stocks (yet) but I do have some ‘green’ stocks in oil companies through follow-this (don’t judge before you see what they do), I didn’t buy these stocks for profit but because I believe in the follow-this cause. To deal in stocks, bonds and ETFs you need a broker, I use degiro but I do not have enough knowledge on different brokers to recommend this one. At Brocolli you can find limited amount of stocks of green start-ups or small businesses.

Bonds

Risk low to moderate, low to moderate potential returns, moderate difficulty, high impact

With buying bonds you are giving a loan to a company or government. The impact of bonds are high as you are directly funding projects with environmental or social benefits. I find is easier to invest in bonds than in stocks but researching individual bonds that fit your morals might still be quite time consuming. I am still looking into this more and at the moment I am hardly directly investing in bonds (I do invest in bonds and stocks through my bank’s impact funds).

ETFs

Risk low, moderate potential returns, moderate difficulty, impact variable

ETFs are a bundle of stocks and bonds that have a specific theme (for example sustainable agriculture). ETFs are an easy way to spread your risk. You can gauge the impact and sustainability of ETFs through certain standards such as ESG (Environment, Social, Government) but most of these standards aren’t perfect (your investing portfolio will also never be perfect but you can try your best:)). I have investments in some ETFs but I found it difficult so far to make sense of all the standards and where to find them for every ETF (please reach out if you have tips). The sites that I have used so far are MSCI and justetf. ETFs are similar to funds at banks but are often passive in a way that they don’t update their stock and bond portfolio, which reduces the extra fee but also might reduce your impact.

Crypto

Risk high, high potential returns, moderate difficulty, low impact

Crypto can have a huge negative environmental impact as many crypto currencies such as bitcoin require computers to run 24/7. However, not all crypto are created equally, Ethereum, for example, does not need computers to run constantly and, thus, uses a lot less electricity. The only real possible positive to crypto is that banks and governments cannot control your money, which is beneficial for people who live under corrupt governments. Also people that have no access to the traditional finance system can benefit hugely from cryptocurrency. That said crypto is still a high risk investment with very little other positive impacts, so only invest if you are a gambler or are a crypto nerd (I have a small amount of Ethereum because I am a curious).

My fave: Crowdfunding

Risk high, high potential returns, low to moderate difficulty, high impact

With crowdfunding you are investing in startups together with a large number of other investors. The impact of crowdfunding can be high if you choose companies that have a positive environmental or social impact. You make money from the interest that you get periodically over a set time frame. The risk is high as startups often fail. Therefore, I would suggest to do your research well before investing and not to bet on only one horse. Normally, you can start investing from around 250 euros but it also depends on the crowdfunding project. You can not get your money back during the investment period, which can run for years! I use platforms such as Duurzaam Investeren and Invesdor to find crowdfunding projects. Before I invest, I read through their businessplans and search for their website to see if I trust my money with them. I especially look at their risk factors and how they plan to mitigate their risk. I prioritise companies that are led by women or marginalized groups.

Also my fave: Spend your money wisely

Risk low, easy, high impact

Besides investing, I still think it is really important to think about what you spend your money on in day-to-day life. Literally any money you spend makes an impact. Spending your money on fast fashion or industrial animal products is not only funding the industries you might despise but it shows those industries that they can make money of their horrendous activies. You vote with your money! Often times we don’t even need the products that we spend our money on, so you will save money! If you do want to shop, shop sustainbly or second hand but always think twice before you buy :). New things will only bring you happiness for a short amount of time but not buying things will bring us a healthy planet for the rest of our lives.